The AI Graveyard: Lessons from 738 Failed AI Projects and Keys to Survival

This list has 738 names, among them are some once-prominent AI projects, such as OpenAI's Whisper.ai for voice recognition, FreewayML, and StockAI by Stable Diffusion, and the AI search engine Neeva, once touted as a "Google competitor."

"In the process, we found that building a search engine was one thing, but convincing users to switch to a better alternative was another," wrote Sridhar Ramaswamy and Vivek Raghunathan, co-founders of Neeva, in their blog post announcing Neeva's closure.

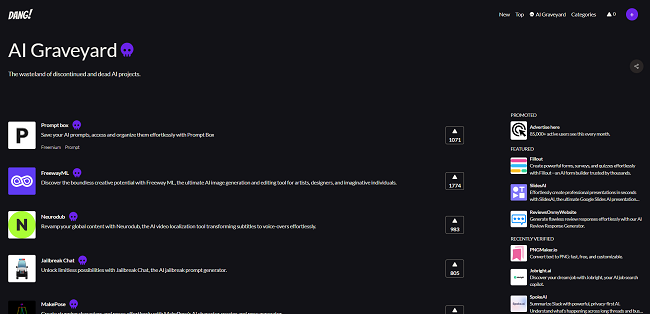

This list of dead AI projects comes from a subpage of the AI tool aggregation site "DANG!"—the AI Graveyard. The AI Graveyard page details most projects' background, functionality, technology, and death dates, like epitaphs carved in cyberspace.

According to statistics, as of June 2024, this list includes 738 AI projects that have ceased operations or are no longer running. Specifically:

- 271 Chatbot and AI writing projects (text-to-text), accounting for about 37%;

- 216 AI drawing and design projects (text-to-image), accounting for about 29%;

- 73 AI voice and video projects (text-to-audio/video), accounting for about 10%;

- Other AI tools, such as code generation and SEO optimization tools, accounting for about 24%.

Why Did They Die?

1. Not only 'mock-up'' but also 'poor mock-up'

In the AI Graveyard, many products are 'mock-up' products. This usually refers to a product that only has the appearance and basic structure, but lacks full functionality or is just used for display purposes.

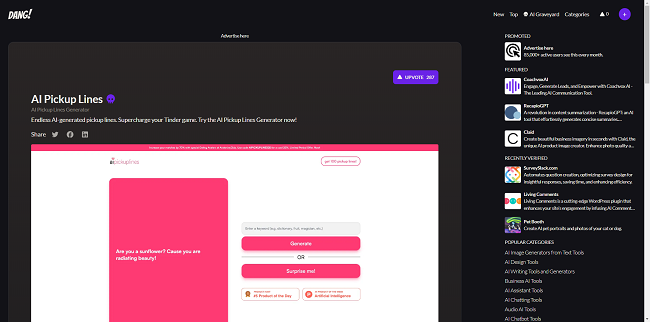

Take AI Pickup Lines, for example, where users could generate 10 pickup lines daily for free or opt for a paid subscription of $9.99/month or $99.99/year for unlimited pickup lines with any keyword. Users could also purchase a comprehensive database for $499.99, gaining access to over 100,000 themed and styled pickup lines.

However, AI Pickup Lines had a short lifespan, launching at the end of 2022 and shutting down in early 2023.

The primary reason for AI Pickup Lines' closure was its entertainment value over practical use. As competing large models grew more capable, products accessing a single API struggled to handle complex, varied social scenarios, thinning their barriers. Additionally, while such products might generate income through ads or one-time purchases, they often lacked long-term user retention and profitability, ultimately leading to shutdowns. The same logic applies to AI Weekly Report Generators and AI Girlfriend Text Generators.

'Mock-up' itself isn't a derogatory term, but its vague definition leads to diverse interpretations. Former Yuque designer and current AI assistant Monica co-founder Suki shared four levels of 'mock-up' on Jike:

1. Directly quoting the OpenAI interface: ChatGPT's answers are mirrored by the shell product. Compete in UI, form, and cost.

2. Building Prompts: Large models can be compared to R&D, with prompts analogous to requirement documents. The clearer the prompt, the more accurately the model performs. Shell products can accumulate high-quality prompts and distribute them effectively.

3. Embedding specific datasets: Converting datasets into vectors to construct their own vector databases for answering questions that ChatGPT cannot, such as in niche fields or private data. Embedding allows for more precise retrieval than prompts.

4. Fine-Tuning: Using quality Q&A data for secondary training, making the model better understand specific tasks. Compared to embedding and prompts, fine-tuning consumes fewer tokens and responds faster.

If we include pre-training following Llama2 architecture, it could be considered a fifth level. These five levels encompass nearly every scenario for 'shelling' large models.

Despite the variations in 'mock-up,' many products survive and thrive due to thoughtful design and effective pricing strategies.

For example, the AI assistant Monica, upgraded from ChatGPT for Google, integrates models like GPT-4, Gemini, Claude, and Llama 3. Its excellent conversation, search, summarizing, translation, spreadsheet processing, and image editing capabilities have garnered millions of users within months.

Similarly, the AI search product Perplexity, known as the 'king of dummy product,' remains a top player due to its fast response speed, precise answers, and multi-round interaction archiving. As of mid-May 2024, Perplexity's daily visits reached 3 million, a fivefold increase from a year earlier.

Perplexity co-founder and CEO Aravind Srinivas stated earlier this year, "People might see Perplexity as a 'mock-up' product, but being a 'Dummy' product with 100,000 users is clearly more meaningful than having a proprietary model without users."

Many independent developers also excel with their 'dummy' products.

For instance, David Bressler, with years of market research experience, used the no-code platform Bubble to build an Excel formula generator named formula bot, earning $26,000 in ARR (Annual Recurring Revenue). Another developer created Chatbase, an AI chatbot platform, achieving an MRR (Monthly Recurring Revenue) of about $64,000. Other successful AI products include Magnific (an image enhancement tool with 720,000 users in five months, later acquired by Freepik) and PDF.ai (understanding PDF documents through Q&A, which broke even within six days and surpassed $300,000 ARR by September 2023).

Thus, many AI products didn't die from 'mock-up' but from 'poor mock-up.'

2. Selling Memberships and Experience Tokens, Then What?

Aside from 'mock-up,' the second major cause of death in the AI Graveyard is a single revenue model, primarily memberships or tokens for experience.

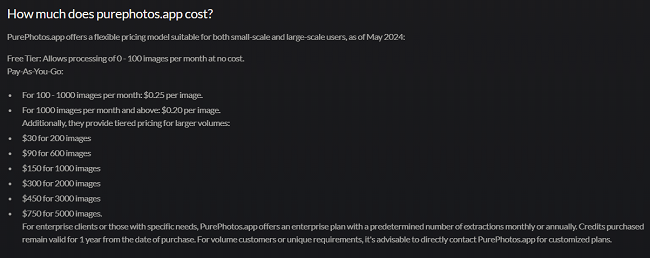

Take text-to-image products Purephotos.app and AnimeAI.lol as examples. Purephotos offers credit purchases for enterprise users, while AnimeAI.lol packages products and services into different plans. Purephotos tried the trendy 'pay-as-you-go' model from May 2024, where the cost per generated image decreases with volume.

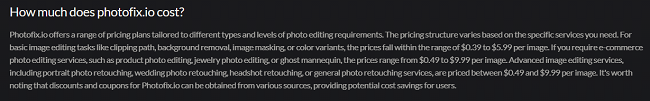

Photofix, an AI photo editing tool, offers 'Basic' and 'Advanced' plans, with the former costing $0.39-5.99 per image and the latter $0.49-9.99 per image.

Even with the 'pay-as-you-go' model, Purephotos couldn't reverse its decline due to the late transition.

Analyzing the pricing strategies of some text-to-image products in the AI Graveyard reveals a common pattern: buying credits, where bulk purchases reduce the per-task cost. However, these products often connect to popular text-to-image model APIs, with prices not much lower than the underlying models. For example, Patience AI, using Stable Diffusion, Waifu Diffusion, and DALL-E, charges $15 for 1,000 credits (about $0.015/credit). Generating an image costs 2 credits ($0.03/image), higher than DALL-E's $0.02/image.

Such unfavorable pricing, combined with insufficient product or technological breakthroughs, predictably leads to their demise.

Even with clever design and reasonable pricing, startups still face challenges when giants enter the field.

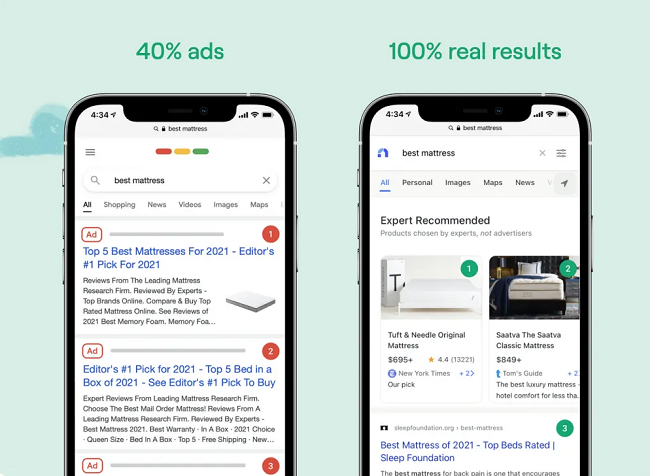

Neeva, once seen as a 'Google competitor,' lies in the AI Graveyard now.

Founded in 2019 by Google's former VP of Ads, Sridhar Ramaswamy, and YouTube's former VP of Monetization, Vivek Raghunathan, Neeva gained attention for its ad-free, tracker-free, privacy-focused search engine.

Unlike many search engines that integrate Google or Bing APIs, Neeva built its search stack from scratch with a 50-person team. Neeva introduced shopping pages with larger images and useful comparison information, prioritizing UGC from Reddit and Quora, and displaying full-screen scoreboards for sports searches. When searching for specific keywords, it could directly take users to the relevant pages.

Neeva officially launched in the US in June 2021, charging $4.95 per month, quickly attracting many users. Within four months, it reached 500,000 monthly active users. By early 2022, Neeva had integrated large language models, becoming the first search engine to provide real-time AI answers with citations for most queries. To expand its user base, Neeva's basic version became free in 2022.

To ride the generative AI wave and seek better growth, Neeva launched the generative AI search product NeevaAI in January 2023. It was one of the first search engines to integrate AI, providing summarized and cited answers to queries. NeevaAI surpassed Microsoft's New Bing and Google's AI search beta in traffic within a month of launch.

Neeva was once a darling of capital, receiving investments from Sequoia Capital, Greylock Partners, and others, totaling $77.5 million.

However, after four years, Neeva couldn't sustain itself. In April 2023, Neeva announced the permanent closure of its search engine. Ramaswamy explained that the challenges of attracting new users and the difficult economic environment led Neeva to shut down its web and consumer search products and pivot to B2B. In May 2023, cloud database company Snowflake acquired Neeva for about $150 million.

Undoubtedly, 'AI search' is a promising product form. From Perplexity in the US to Mita AI in China, stable traffic and growing user numbers validate the real market demand for such products. However, competing in the capital-intensive AI search startup space, dominated by giants like Google and Microsoft, requires not only unparalleled product strength but also substantial marketing investment, demanding high financing capabilities.

Finding a suitable revenue model is also crucial for the success of AI search products. Relying solely on ads might be slow to monetize, while other models (like subscriptions) face challenges in attracting a large user base, as seen in Neeva's slowed user growth post-subscription launch.

3. How Not to End Up in the AI Graveyard

The famous startup incubator Y Combinator summarized 18 ways startups failed in 2006, including burning cash too fast, not making money, lacking computing power, and lacking product differentiation. These 18 causes of death remain deadly 18 years later. Even past high-flying star AI products can hit a wall and become historical dust.

The AI Graveyard primarily includes small to medium-sized companies, but some larger star AI companies are also fading or becoming silent. These companies, once valued at hundreds of millions or billions, have been failing in recent years—Inflection AI is a typical example.

In May 2023, the company launched its first chatbot, Pi, which could have personalized conversations through apps, websites, WhatsApp, Instagram, and Facebook.

Inflection AI co-founder Mustafa Suleyman told Bloomberg that despite attracting significant investor interest, including from Microsoft, and having 1 million daily active users, the company had not found an effective business model.

Inflection AI's example is a cautionary tale—when an AI application company's core product fails to deliver compelling performance, and the model layer faces competitive pressure, the initial logic of "model-driven AI applications" may no longer hold.

Lingyiwanwu founder and CEO Kai-Fu Lee proposed a "TC-PMF" concept this May, suggesting that PMF (Product-Market Fit) is insufficient to define AI-first startups based on large models. He introduced a four-dimensional concept of Technology and Cost, forming "TC-PMF" (Technology-Cost-Product-Market Fit).

Lee argued that training and serving large models are expensive, and compute shortages are a collective challenge for the field. The industry should avoid irrational cash-burning strategies and ensure a healthy ROI for long-term AI development. "Achieving technology-cost-product-market fit, especially reducing inference costs, is a moving target, a hundred times harder than traditional PMF," he explained.

In summary, Inflection AI's failure isn't solely due to product issues but also to a lack of "TC-PMF," focusing too much on fundraising while neglecting cash flow, technical feasibility, and cost control. Even with good market performance, they couldn't avoid acquisition due to commercialization weaknesses.

While learning from failures, most people are more concerned with what kind of AI startups can succeed today.

Two types of companies have a higher chance of survival:

1. Companies that truly understand the needs and pain points of B2B or B2C users.

2. Companies that offer irreplaceable features beyond what generative AI products like ChatGPT and Midjourney provide, mastering specific niche scenarios.

A typical example of the first type is AnswerAI.

AnswerAI is an AI Tutor product targeting the North American market, primarily offering photo-based problem-solving and reasoning. Founder Zhou Li, a 2007 Beijing University master's graduate, previously founded TigerMap, Wandoujia, Kika Keyboard, and LiveIn.

Unlike the first wave of "photo search" AI Tutor 1.0 products, AnswerAI is a 2.0 product that not only searches but also solves problems, providing answers and reasoning processes. It can handle new questions beyond its database, addressing students' pain points of "having answers but not understanding the logic" and "facing new problems." AnswerAI has received rave reviews online, with many users calling it "the best AI product I've ever used."

Data.ai reported on May 21 that five out of the top 20 educational apps in the US app store are AI agents helping students with homework, including AnswerAI.

Currently, TutorAI has over 2 million users worldwide, 80% of whom are high school and college students in the US. It ranks first among AI Tutor products in North America, with an expected ARR of $5 million this year.

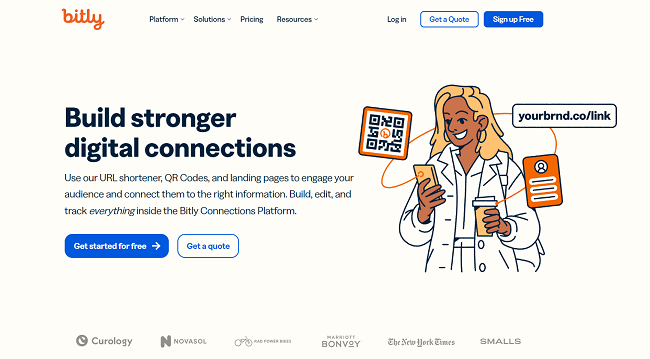

A representative of the second type is Bitly, a URL shortening tool, and vidyo.ai.

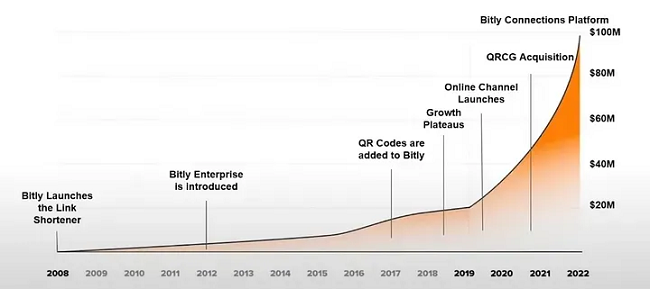

Bitly, headquartered in New York and founded by Peter Stern in 2008, offers URL shortening, dynamic QR codes, and custom link shortening.

This may not seem like a generative AI-era product, but Bitly's simple interface, stable service, and built-in statistics make it widely regarded as the "best short link tool." For example, X (Twitter) quietly replaced its previous URL shortening service, TinyURL, with Bitly. X initially used TinyURL to save character space, automatically shortening long URLs and gaining significant exposure and traffic.

Bitly didn't initially choose a B2C PLG (product-led growth) route but targeted enterprise clients through SLG (sales-led growth), selling its "small screwdriver" to big companies.

Thanks to robust freemium services, Bitly quickly captured a large market share, achieving nearly $20 million in ARR by 2018. After shifting to PLG in 2020, Bitly experienced exponential growth.

Today, this low-key company has broken the "SaaS can't do B2C in the US" curse, surpassing $100 million in ARR. Even with the rise of ChatGPT and other AI tools for URL shortening in 2022, Bitly's growth remained stable.

The reason is simple: when ChatGPT and other AI tools face user requests for URL shortening, they sometimes generate random URLs or use Bitly's domain. However, these Bitly-generated short links are not created within real Bitly accounts, often leading to error pages. Bitly staff have stated on their user service page, "If you're using AI tools to help write your copy, be sure to check your links before publishing or printing your text."

Similar to Bitly's approach, vidyo.ai is an AI video editing tool platform.

Vidyo.ai automatically converts long videos into short clips. Users can upload videos or paste links into vidyo.ai, which automatically edits the highlights, tracks faces, adds subtitles, and adapts to various short video formats. Vidyo.ai reduces video editing and processing time by up to 90%, allowing tasks that previously took three people a week to complete in just 15 minutes.

While AI video generation products like Runway, Pika, PixVerse, and Sora focus on the production end, they overlook consumer needs—short videos ultimately serve users. Vidyo.ai captures this gap by creating an AI video editing product that meets market demands, securing its place in the AI video ecosystem.

Joining the international investment incubator Entrepreneur First in 2021, vidyo.ai raised $1.1 million in seed funding in 2022. By 2023, it had over 500,000 users and an ARR of $1.5 million.

Conclusion

The AI Graveyard serves as a stark reminder of the challenges in the AI industry. While many projects have failed, understanding the reasons behind their demise provides valuable lessons. Success in the AI industry requires a deep understanding of user needs, innovative and well-executed 'mock-up,' and sustainable business models. Companies that can navigate these challenges and offer unique, irreplaceable features have a higher chance of thriving in this competitive landscape. The stories of Bitly, vidyo.ai, and AnswerAI highlight the importance of addressing real market demands and creating robust, user-focused products. As the AI field continues to evolve, adaptability and a keen sense of market dynamics will be crucial for future success.